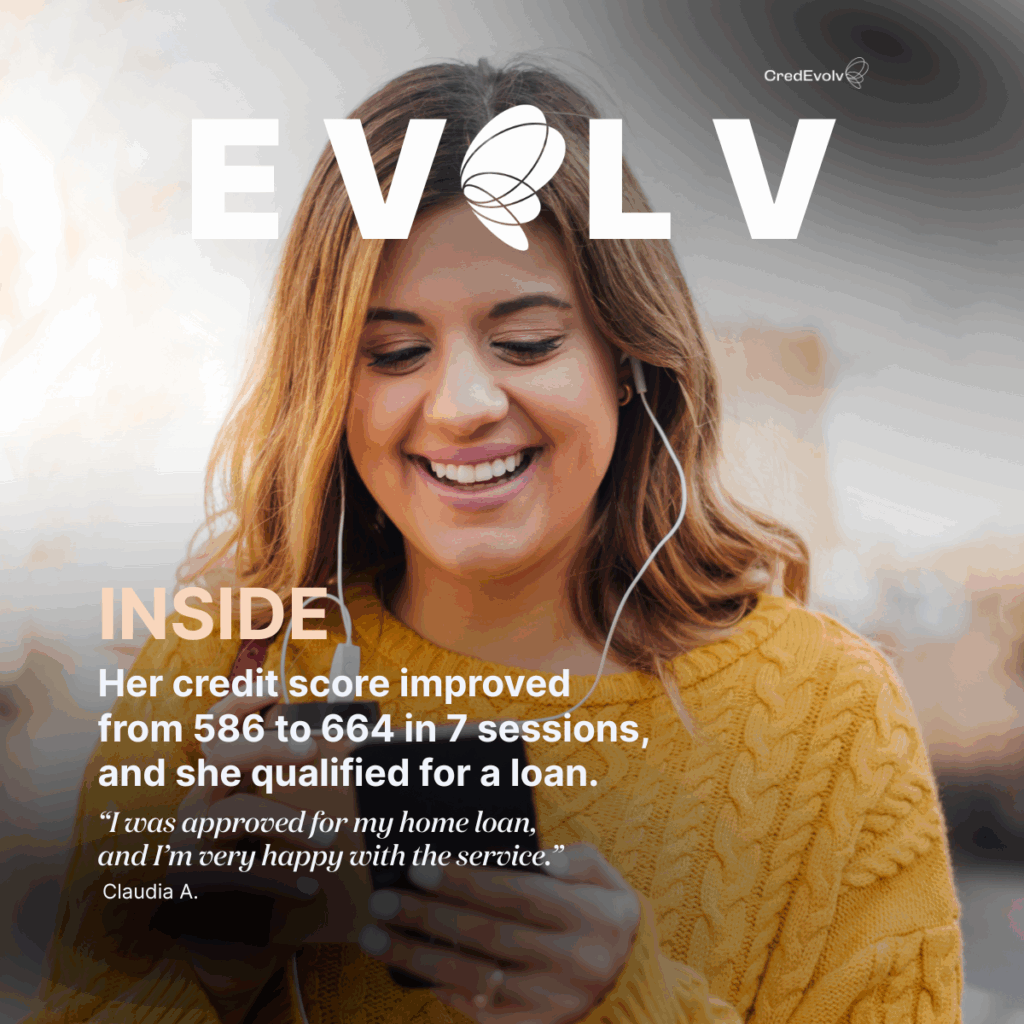

When PRMG referred Claudia A. to our nonprofit counseling partners, she was ready to write her own credit success story. Claudia began with a 586 score, several late payments, and a high credit card utilization at 54 percent. Homeownership felt close, but not quite within reach. With a clear plan, consistent follow through, and expert guidance, that changed fast.

The Starting Point

Claudia’s goals were simple and specific – clean up past late payments and build a budget that would lower balances and protect on-time payments. She met with a certified nonprofit counselor and mapped out seven focused sessions. Each one came with small actions she could take right away, plus checkpoints to track progress.

The Game Plan

Claudia and her counselor started with a full audit of her credit reports to resolve late marks. Next, they built a realistic budget that created room for targeted pay-downs. Finally, they synced due dates, turned on reminders, and locked in a simple habit loop – review, pay, confirm. No gimmicks, just a framework that turns effort into results.

What Changed

Over seven sessions, Claudia followed the plan and stayed consistent between meetings. The numbers tell the story:

- Utilization dropped from 54 percent to 8 percent

- Score improved from 586 to 664 – a 78 point increase

- Late payments were addressed and new lates were avoided

- Habits shifted from reactive to proactive budgeting

With utilization now in a healthy range and her history trending positive, Claudia’s profile became far more mortgage ready.

The Outcome

Claudia reached the milestone she had been working toward – loan approval.

“I was approved for my home loan, and I’m very happy with the service.”

That short line says a lot about the power of a focused plan. It also shows how strong lender partnerships help consumers win.

- PRMG made the referral.

- Our nonprofit counselors provided the roadmap.

- Claudia did the work and owned the result.

Why this Approach Works

Credit improvement is not guesswork. It is a sequence. Identify the blockers. Set a budget that sticks. Lower utilization with intention. Protect on time payments. Track progress in short cycles. When you pair that sequence with support from certified, nonprofit counselors – and a warm handoff from a partner like PRMG – momentum builds and confidence follows.

Ready to Start Your Own Success Story

If you have credit or debt challenges, you do not have to figure it out alone. A clear plan and steady action can change your profile in a matter of weeks. Start with a review, commit to a few small steps, and keep moving. Your credit success story can begin today.