Key takeaways about having a healthy credit score:

- A healthy credit score opens doors to opportunities that can significantly improve your quality of life.

- There are many reasons to be proud of having a healthy credit score, including feeling better about yourself and enjoying financial peace of mind.

- You can build and maintain a healthy credit score by paying your bills on time, keeping your credit card balances low, and more.

- Achieving a healthy credit score is a journey that requires patience and diligence, but the rewards are well worth the effort.

When people put in the work and exhibit the discipline to become more physically fit, it’s no surprise that they often start wearing better-fitting clothes and carrying themselves with an aura of confidence. Who can blame them?

Similar things happen when people achieve a healthy credit score – especially if they’ve brought theirs up from a level that was holding them back in life. While we would never recommend flaunting or bragging about your financial well-being, you should take plenty of pride in having good to great credit!

That’s because a credit score is a testament to your personal priorities and financial responsibility. From buying a home or a car to securing a favorable interest rate on a credit card or another type of loan, a strong credit score opens doors to opportunities that can significantly improve your quality of life.

Let’s take a look at why you should feel great about having and maintaining a healthy credit score and learn some actionable tips for building and sustaining good credit.

Why should you be proud of a healthy credit score?

- Feeling better about yourself. Let’s start with perhaps the biggest benefit of having good credit. When you do, you feel confident about being able to provide for yourself and your family – and you can’t put a price tag on the self-esteem that comes from honoring your obligations and being someone who others can trust, especially with money.

- Access to better financial products. A high credit score makes you an attractive candidate for lenders. Banks and financial institutions are more likely to offer you better loan terms (more on that next), credit cards with rewards, and higher credit limits. This can save you a substantial amount of money in the long run and provide you with better financial flexibility.

- Lower interest rates. One of the most significant advantages of a high credit score is the ability to secure loans and credit at lower interest rates. This means you’ll pay less over the life of a loan, whether it’s a mortgage, car loan, or personal loan. Lower interest rates translate to lower monthly payments, freeing up your finances for other purposes.

- Higher chances of loan approval. Your credit score is one of the first things lenders look at when you apply for credit. A healthy credit score increases your chances of getting approved for loans and credit cards. It also reduces the stress and uncertainty of being denied credit when you need it the most.

- Better insurance rates. Many insurance companies use credit scores to determine premiums for auto, home, and life insurance. A higher credit score can result in lower premiums, saving you money on essential insurance products.

- More renting opportunities. If you’re looking to rent an apartment or house, a good credit score is becoming a more common deciding factor for landlords. It signals that you are a reliable tenant who is likely to pay rent on time. In competitive rental markets, a strong credit score can give you an edge over other applicants.

- Financial peace of mind. Knowing that you have a healthy credit score can provide significant peace of mind. It means you’ve managed your finances well and have the ability to handle emergencies that require credit. This self-assurance can reduce financial stress and contribute to your overall well-being.

A healthy credit score is a powerful tool that reflects your financial responsibility and can unlock numerous benefits.

How can you build and maintain good credit?

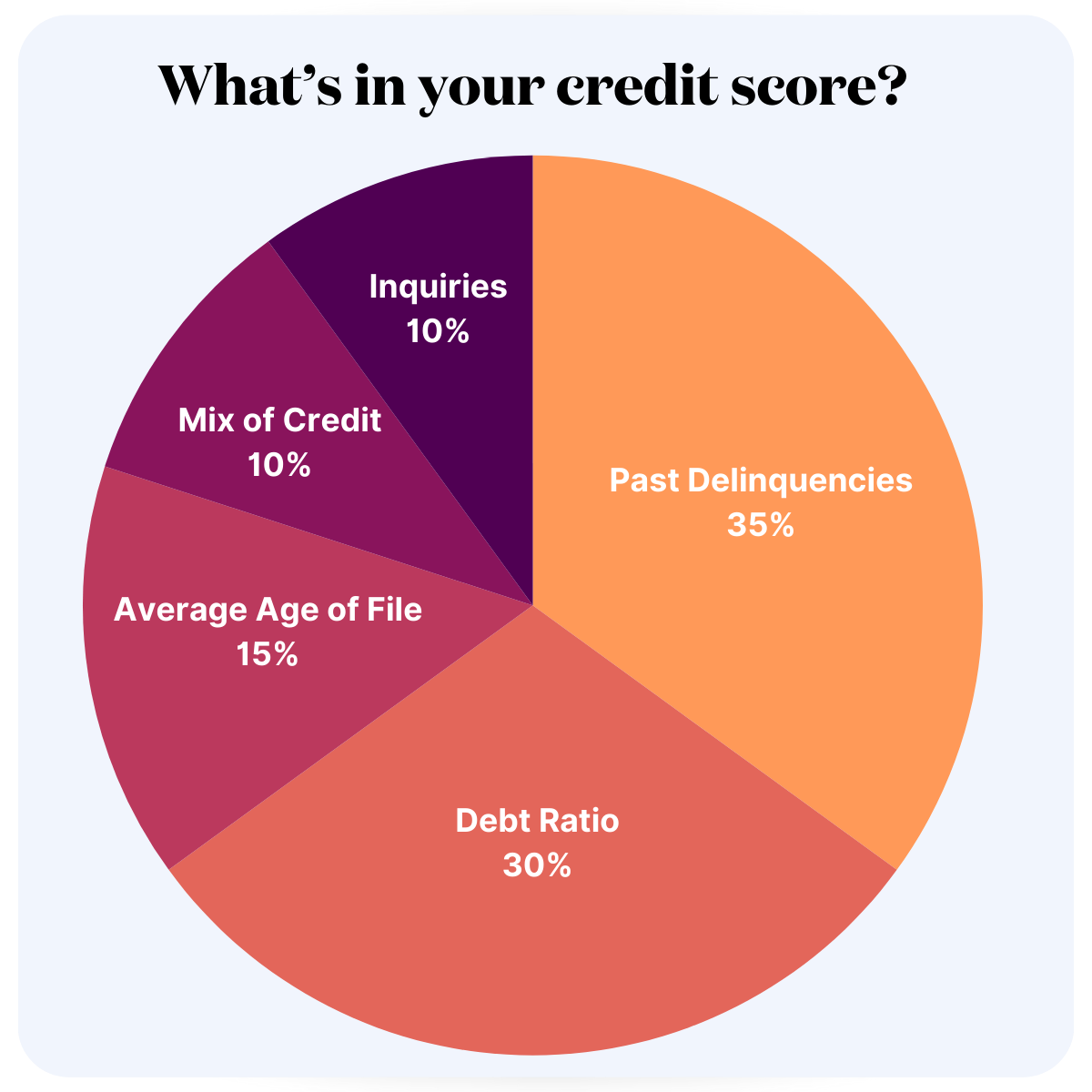

- Pay your bills on time. Payment history is the most crucial factor in your credit score. Be adamant about paying all your bills – including credit cards, loans, utilities, and housing costs – on time every month. Setting up automatic payments or reminders can help you stay on track.

- Keep credit card balances low. Your credit utilization ratio is the amount of credit you’re using compared to your total available credit. This number plays a significant role in your credit score. Aim to keep your credit utilization below 30 percent. If possible, pay off your credit card balances in full each month.

- Avoid opening too many new accounts. Each time you apply for new credit, it results in a hard inquiry on your credit report. This type of inquiry can temporarily lower your credit score. Several of them, especially in a short period of time, can lower your score even more. Instead of opening new accounts, focus on managing existing accounts responsibly.

- Keep existing long-term accounts open. The length of your credit history affects your credit score. Keeping older accounts open, even if you don’t use them frequently, can help increase the average age of your credit accounts. This demonstrates a longer history of responsible credit management.

- Diversify your credit mix. Having a variety of credit types – such as credit cards, installment loans, and mortgages – can positively impact your credit score. Lenders like to see that you can manage different types of credit responsibly.

- Regularly check your credit report. Reviewing your credit report often helps you stay informed about your credit status. You can also spot any errors or fraudulent activity before the damage becomes excessive. You can obtain a free credit report annually from each of the three major credit bureaus (Equifax, Experian, and TransUnion) at AnnualCreditReport.com.

- Seek professional credit counseling if needed. If you’re struggling to build or maintain good credit, consider seeking advice from a financial advisor or credit counseling service. Ideally you should avoid traditional credit repair companies and work with a nonprofit service that employs certified credit coaches. They can provide personalized strategies and support to help you improve your credit health. These are the only coaches we partner with at CredEvolv, and our tech platform facilitates the relationships between consumers, counselors, and connectors like nothing else out there.

Conclusion

We say it often, but we can never say it enough: A healthy credit score is a powerful tool that reflects your financial responsibility and can unlock numerous benefits. The CredEvolv platform is built to help you understand the importance of good credit and adopt smart financial habits so you can build and maintain a credit score that you can be proud of! Achieving a healthy credit score is a journey that requires patience and diligence, but the rewards are well worth the effort – and we’re here to help you!

Enroll with us today and start taking pride in your financial achievements as you continue to strive for excellence in managing your credit. We look forward to connecting you with the right people who can put you on the right path!