Key takeaways about debt and credit:

- Understanding debt and credit can transform the way you think about your finances and open doors to opportunities.

- One of the primary ways investors use debt is through leverage (occasionally borrowing money to increase the potential return on investment).

- Smart investors also use low-interest loans to fund their investments. When the interest rate on borrowed money is lower than the return on the investment, the investor can pocket the difference.

- Whether they’re investors or not, smart people prioritize building and maintaining good credit to ensure they can enjoy the most advantageous terms possible when they need to borrow money.

When people hear the word “debt,” it often conjures images of financial distress, late payments, collections, and disastrous credit reports. The same goes for “borrowers.”

However, for “investors” – a word that has a much more positive connotation – debt is less of a burden. It’s more of a powerful tool that, when used wisely, can lead to significant wealth accumulation.

Of course, you can’t even begin to use debt to your advantage if you don’t have good credit. And if that’s the case, CredEvolv can help you (more on that later).

Understanding how to leverage debt and credit can transform the way you think about your finances. It can also open doors to opportunities that might otherwise have been inaccessible. Here are a few of the ways smart investors use debt and credit to benefit themselves.

Before you read on, remember that we are not financial advisors or investment experts. You should always consult one or both before you forge ahead with any investment strategy.

Leveraging debt and credit to amplify returns.

One of the primary ways investors use debt is through leverage. This involves occasionally borrowing money to increase the potential return on investment. This strategy is commonly used by real estate investors, who often use mortgages to purchase properties.

Instead of paying the full price up front in cash, they make a down payment and finance the rest. This allows them to acquire more properties than they could if they were buying them outright.

The resale or rental income generated from these properties can usually cover the purchase price or the mortgage payments and still provide a profit. Over time, as property values appreciate, the investor’s equity in the properties grows. This can lead to substantial returns when it comes time to sell or access the accumulated equity.

Using low-interest loans for investment.

Smart investors often take advantage of low-interest loans to fund their investments. When the interest rate on borrowed money is lower than the return on the investment, the investor can pocket the difference.

For example, with home equity loans and lines of credit (HELOCs), property owners can tap into the equity in their homes to secure low-interest loans. These funds can then be used to invest in higher-yield opportunities. The interest paid on these loans may also be tax-deductible, further enhancing their attractiveness (consult with a tax professional for specific details).

With business loans, entrepreneurs might have a lower-interest way to expand their operations, purchase new equipment, or invest in new projects. If the business generates a return that exceeds the cost of the loan, this can be a highly effective use of debt.

Whether they’re investors or not, smart people prioritize building and maintaining good credit to ensure they can enjoy the most advantageous terms possible when they need to borrow money.

Using credit cards for short-term financing.

While credit cards are sometimes seen as a means of making everyday purchases – and not an ideal way, at that, even in our increasingly cashless society – investors may find them strategically useful for short-term financing and rewards.

Some credit cards offer an introductory 0% interest rate on purchases or balance transfers for a specified period. Investors can use these offers to finance other money moves without incurring interest, provided they pay off the balance before the promotional period ends.

Additionally, by using credit cards that offer rewards or cash back, investors can earn money on their regular expenditures. These rewards can be reinvested or used to offset other costs.

Having good credit.

Of course, being able to do any or all of the above is contingent upon a strong credit profile. Whether they’re investors or not, smart people prioritize building and maintaining good credit to ensure they can enjoy the most advantageous terms possible when they need to borrow money. This involves:

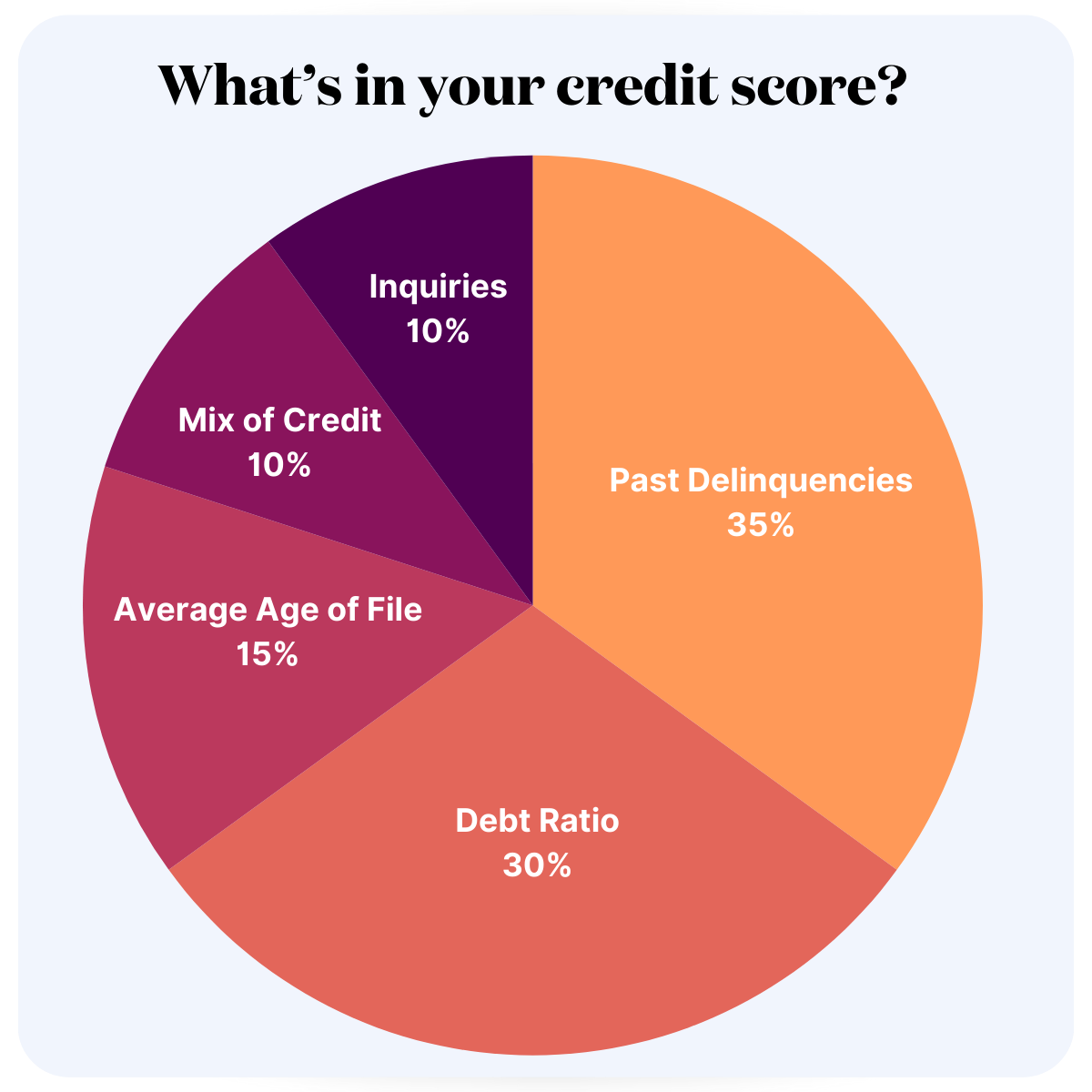

- Making timely payments on all debts (the most critical factor in maintaining a strong credit score).

- Keeping credit utilization low (ideally below 30% of available credit).

- Having a mix of credit types (such as revolving credit like credit cards and installment loans like mortgages and car notes).

Conclusion

Debt and credit, when used judiciously, can be powerful tools in an investor’s arsenal. The key is to use them strategically and responsibly, always weighing the potential returns against the risks. Always heed the advice of a trusted financial advisor or investment expert!

Remember, while debt can be beneficial, it’s essential to have a solid plan and to consider the risks involved. Over-leveraging or mismanaging debt can lead to financial difficulties. It’s a necessity to approach these strategies with caution (and ideally under the guidance of the professionals we’ve mentioned).

If you plan to do that or you’ve already done so, that’s smart! If your credit isn’t quite where you need it to be, you should be smart about that too. Work with us! At CredEvolv, we only partner with certified, nonprofit credit counselors who can get you the results you’re looking for – legally, ethically, and without the pitfalls of all those scammy, for-profit credit repair companies out there.

Whenever you need our help in that area, we’re here for you. Because with careful planning, disciplined execution, and excellent credit, debt can indeed be a friend rather than a foe in the journey to financial success!